Open cit bank account – Open Citibank account – those three words unlock a world of financial possibilities! Imagine effortlessly managing your money, accessing cutting-edge banking technology, and enjoying a level of service that simplifies your financial life. This isn’t just about opening an account; it’s about embarking on a journey towards smarter, more secure, and more convenient banking. We’ll explore everything from eligibility requirements and account types to online security and international options, painting a complete picture of what it means to bank with Citi.

Whether you’re a seasoned financial planner or just starting out, understanding the ins and outs of Citibank accounts is key to maximizing your financial well-being. We’ll delve into the specifics of various account types, comparing their features, fees, and minimum balance requirements. We’ll also guide you through the seamless online account opening process, ensuring you feel confident and secure every step of the way.

Prepare to discover a banking experience that’s both powerful and user-friendly.

Eligibility Requirements for Opening a Citibank Account

Opening a Citibank account grants access to a range of financial services, from convenient checking accounts to robust investment options. However, eligibility hinges on several key factors. Understanding these requirements ensures a smooth and efficient account opening process.

Minimum Age Requirements

Applicants must be at least 18 years of age to open a standard Citibank account. For specific accounts targeting younger demographics, such as student accounts, the minimum age may vary. Always check the specific requirements for the account type you are interested in.

Required Documentation

The documentation needed varies depending on the account type. For a checking account, you will typically need a government-issued photo ID (such as a driver’s license or passport) and proof of address (such as a utility bill or bank statement). Savings accounts often require similar documentation. More complex accounts, like business accounts, will necessitate additional documentation such as business registration certificates.

Online Identity Verification

Verifying your identity during online account opening is a multi-step process designed to ensure security. This typically involves providing personal information matching your government-issued ID, answering security questions, and potentially undergoing additional verification steps such as providing a copy of your ID or confirming information with a third-party verification service. Citibank utilizes advanced security protocols to protect your data during this process.

Residency Requirements

Citibank typically requires applicants to be legal residents of the country where they are applying for the account. Specific residency requirements may vary depending on the location and the type of account being opened. International students may have different eligibility criteria compared to permanent residents or citizens.

Types of Citibank Accounts Available: Open Cit Bank Account

Citibank offers a variety of accounts designed to cater to diverse financial needs and goals. Understanding the features, fees, and minimum balance requirements of each account type is crucial in selecting the most suitable option.

Comparison of Citibank Account Options

| Account Type | Features | Fees | Minimum Balance |

|---|---|---|---|

| Checking Account | Debit card, online banking, bill pay, check writing | Monthly maintenance fee (may vary), overdraft fees | Varies depending on account type |

| Savings Account | Higher interest rates than checking, online banking | Monthly maintenance fee (may vary) | Varies depending on account type |

| Money Market Account | Higher interest rates than savings, check writing, debit card | Monthly maintenance fee (may vary), potential minimum balance fees | Typically higher than savings accounts |

Benefits and Drawbacks of Each Account Type

A checking account provides convenient access to funds for daily transactions, but interest rates are typically low. A savings account offers higher interest rates for accumulating savings, but access to funds may be limited. A money market account offers a balance between liquidity and higher interest rates, but typically requires a higher minimum balance.

Account Type Suitability

A checking account is ideal for managing daily expenses, while a savings account is better suited for long-term savings goals. A money market account can be a good choice for individuals who want higher interest rates but also need access to their funds.

The Online Account Opening Process

Opening a Citibank account online is a streamlined process. A clear understanding of the steps involved and the security measures in place will ensure a secure and efficient experience.

Online Account Opening Flowchart

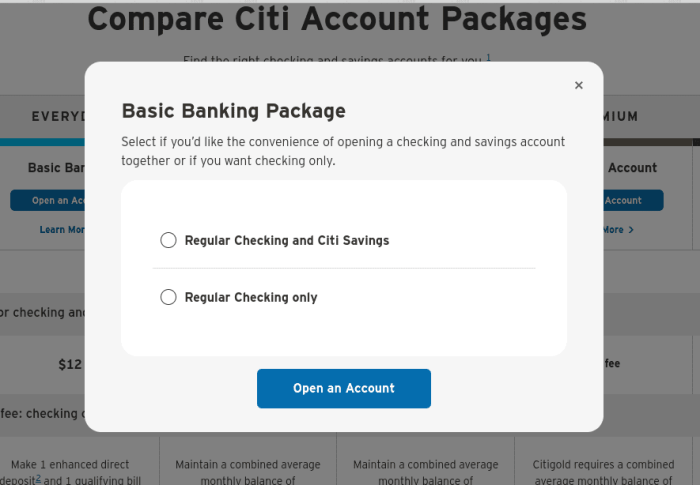

A flowchart would visually depict the steps: 1. Visit the Citibank website; 2. Select “Open an Account”; 3. Choose account type; 4. Complete application form; 5.

Verify identity; 6. Review and submit; 7. Account activation. Each step would be represented by a box, with arrows indicating the flow.

Online Application Form Details

The online application form requires personal information such as name, address, date of birth, Social Security number (or equivalent), and employment details. It also requests financial information relevant to the account type being opened.

Online Application Security

Citibank employs robust security measures such as encryption and fraud detection systems to protect customer information during the online application process. Multi-factor authentication adds an extra layer of security.

Fees and Charges Associated with Citibank Accounts

Several fees are associated with Citibank accounts. Understanding these fees and how to minimize them is important for effective financial management.

Common Citibank Fees

Source: thepointsguy.com

- Monthly maintenance fees

- Overdraft fees

- ATM fees (out-of-network)

- Wire transfer fees

- Foreign transaction fees

Minimizing Citibank Fees

Maintaining a minimum balance, utilizing in-network ATMs, and avoiding overdrafts are effective strategies for minimizing fees. Some accounts offer fee waivers under certain conditions.

Fee Comparison with Other Banks

Citibank’s fees are generally comparable to those of other major banks. However, specific fees may vary depending on the account type and the bank. Comparing fee schedules across different banks is recommended before making a decision.

Customer Service and Support Options

Citibank provides multiple channels for customer support, ensuring convenient access to assistance when needed.

Contacting Citibank Customer Service

Customers can contact Citibank customer service via phone, email, or online chat. Contact information is readily available on the Citibank website.

Thinking of opening a CIT Bank account? It’s a smart move, but first, you might wonder, “What exactly is CIT Bank?” To understand the benefits of opening an account, it helps to know the bank itself; find out more by checking out this helpful resource: what is a cit bank. Once you’re familiar with CIT Bank’s offerings, you can confidently decide if opening an account is the right financial choice for you.

Accessing Account Statements and Transaction History

Account statements and transaction history are easily accessible online through the Citibank website or mobile app.

Resolving Account-Related Issues

Citibank provides various methods for resolving account-related issues, including phone support, online messaging, and in-person visits to branches (where available).

Security Measures for Citibank Accounts

Citibank employs a range of security features to protect customer accounts and information.

Citibank Security Features

Citibank utilizes two-factor authentication, fraud monitoring, and encryption to protect customer accounts. Regular security updates and patches further enhance security.

Best Practices for Online Banking Security

Strong passwords, avoiding public Wi-Fi for online banking, and regularly monitoring account activity are crucial security best practices.

Responding to Compromised Accounts

If an account is compromised, immediately contact Citibank customer service to report the issue and take steps to secure the account.

International Account Options

Citibank offers both domestic and international account options, catering to customers with diverse financial needs.

Domestic vs. International Accounts

Domestic accounts are tailored to the specific regulations and currency of the customer’s country of residence. International accounts provide access to global banking services, often involving multiple currencies and international transfers.

International Account Requirements

Opening an international account typically involves additional documentation, such as proof of foreign residency and tax identification numbers.

Challenges and Benefits of International Accounts

International accounts offer convenience for managing finances across borders, but they may involve higher fees and more complex regulatory requirements.

Alternative Ways to Access Banking Services

Citibank offers various convenient methods for accessing banking services beyond traditional branch visits.

Citibank Mobile App Features, Open cit bank account

The Citibank mobile app provides features such as account balance checks, fund transfers, bill payments, and location services for nearby ATMs.

Citibank ATM Network Usage

Citibank’s ATM network offers convenient access to cash withdrawals and deposits.

Managing Accounts via the Citibank Website

The Citibank website provides a comprehensive platform for managing accounts, including reviewing statements, transferring funds, and contacting customer service.

Final Conclusion

Source: thesmartinvestor.com

So, there you have it – a comprehensive look at opening a Citibank account. From understanding the eligibility criteria and choosing the perfect account type to navigating the online application and maximizing your account security, we’ve covered it all. Remember, banking shouldn’t be a chore; it should be a seamless and empowering experience. Citibank aims to provide just that, equipping you with the tools and resources to manage your finances with confidence and ease.

Take the leap and unlock the potential of effortless banking – your financial future awaits!