CIT Bank asset size is a crucial indicator of the bank’s financial health and stability. Understanding its asset composition, growth trajectory, and comparison to industry peers provides valuable insights into the bank’s overall performance and risk profile. Analyzing this data allows for a comprehensive assessment of CIT Bank’s capacity to meet its obligations and its potential for future growth.

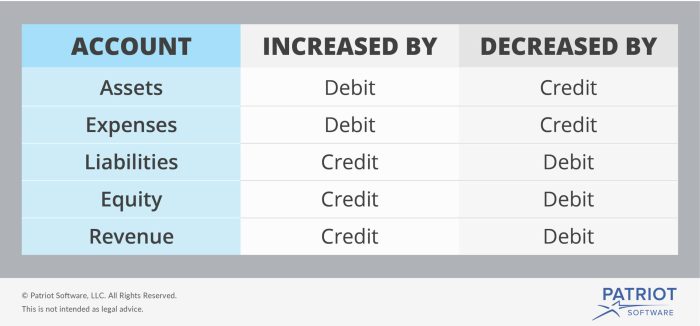

Source: patriotsoftware.com

This overview explores the key aspects of CIT Bank’s asset size and its implications.

A detailed examination of CIT Bank’s asset size requires looking beyond the simple numerical value. We need to consider the types of assets held, their liquidity, and the overall diversification of the portfolio. This involves analyzing the proportion of loans, securities, and other assets, assessing their credit quality, and considering potential risks associated with each asset class.

By understanding the composition of CIT Bank’s assets, we can gain a deeper understanding of its financial strength and vulnerability to market fluctuations.

Hey, urban Jakartans! Let’s talk serious business – CIMB Niaga’s asset size. It’s a big deal, especially if you’re into finance, investing, or just curious about the economic pulse of our city. This isn’t your typical stuffy financial report; we’re breaking it down in a way that’s easy to digest, even if you’re more into

-kopi susu* than corporate balance sheets.

We’ll explore CIMB Niaga’s asset growth, its key components, and what it all means for the Indonesian economy.

Understanding CIMB Niaga’s Asset Size: The Big Picture

CIMB Niaga (PT Bank CIMB Niaga Tbk), one of Indonesia’s leading banks, boasts a significant asset base. Its asset size reflects its overall financial strength and market position. Think of it like this: the bigger the asset size, generally the more financially stable and influential the bank is. But it’s not just about the sheer number; we need to understand

-what* makes up those assets.

Key Components of CIMB Niaga’s Assets

- Loans and Advances to Customers: This is usually the largest chunk of a bank’s assets. It includes various loans like mortgages, personal loans, and business loans. The quality and diversification of these loans are crucial for the bank’s health.

- Investment Securities: Banks invest in various securities like government bonds, corporate bonds, and stocks. These investments generate income and contribute to the overall asset base. The risk profile of these investments is a key factor to consider.

- Cash and Balances with Central Bank: This represents the bank’s readily available funds, crucial for daily operations and meeting customer demands. A healthy cash reserve is essential for liquidity and stability.

- Property, Plant, and Equipment (PP&E): This includes the bank’s physical assets like buildings, technology infrastructure, and other equipment. While not the biggest portion, it’s still a significant part of the overall picture.

- Other Assets: This category encompasses a variety of smaller assets, including intangible assets and other receivables.

Analyzing CIMB Niaga’s Asset Growth Over Time

To truly understand CIMB Niaga’s asset size, we need to look at its growth trajectory. Has it been consistently expanding? What factors have driven this growth? Analyzing historical data provides valuable insights into the bank’s performance and future prospects. You can find this data in their annual reports and financial statements, readily available on their website and through reputable financial news sources.

Factors Influencing Asset Growth

- Economic Growth in Indonesia: A booming Indonesian economy generally translates to increased lending activities and higher demand for banking services, boosting asset growth.

- Strategic Acquisitions and Mergers: Acquisitions can significantly increase a bank’s asset size and market share. CIMB Niaga’s history might reveal such strategic moves.

- Effective Lending Strategies: A bank’s ability to effectively manage and expand its loan portfolio is a key driver of asset growth.

- Investment Performance: Successful investment strategies in securities can significantly contribute to asset growth.

- Regulatory Changes: Changes in banking regulations can influence a bank’s lending practices and investment strategies, impacting asset growth.

CIMB Niaga’s Asset Size Compared to Competitors: Cit Bank Asset Size

To get a better perspective, it’s crucial to compare CIMB Niaga’s asset size with its main competitors in the Indonesian banking sector. This comparative analysis helps us understand its relative market position and competitive strength. You can find this data through various financial news websites and reports specializing in Indonesian banking.

Benchmarking Against Competitors, Cit bank asset size

By comparing key financial metrics, such as Return on Assets (ROA) and Return on Equity (ROE), alongside asset size, we can gain a more nuanced understanding of CIMB Niaga’s performance relative to its peers. This helps to assess efficiency and profitability in relation to the scale of its operations.

The Significance of CIMB Niaga’s Asset Size for the Indonesian Economy

CIMB Niaga’s substantial asset size plays a significant role in the Indonesian economy. As a major player in the financial sector, its stability and growth contribute to overall economic health. Its lending activities fuel businesses, infrastructure development, and consumer spending.

Impact on Economic Growth

- Credit Provision to Businesses: CIMB Niaga’s loans support businesses of all sizes, contributing to job creation and economic expansion.

- Infrastructure Financing: The bank’s involvement in financing infrastructure projects helps to improve the country’s infrastructure and facilitate economic activity.

- Financial Inclusion: CIMB Niaga’s reach and services contribute to financial inclusion, bringing banking services to a wider segment of the population.

Frequently Asked Questions (FAQ)

- Q: Where can I find the most up-to-date information on CIMB Niaga’s asset size?

A: CIMB Niaga’s official website, reputable financial news sources, and their annual reports are excellent resources.

- Q: What are the risks associated with a large asset size?

A: While a large asset size generally indicates strength, it also means a higher level of risk exposure, especially in times of economic downturn.

- Q: How does CIMB Niaga’s asset size compare to other Southeast Asian banks?

A: This requires a broader comparative analysis involving other major banks in the region. Financial news websites and industry reports are good sources for this.

- Q: What is the impact of fluctuating exchange rates on CIMB Niaga’s asset size?

A: Fluctuations in exchange rates can affect the value of assets denominated in foreign currencies, impacting the overall asset size reported in Indonesian Rupiah.

- Q: How does CIMB Niaga manage its risk associated with its large asset base?

A: CIMB Niaga likely employs various risk management strategies, including diversification, credit scoring, and stress testing, to mitigate risks associated with its substantial asset base. Details can often be found in their annual reports.

Ready to Dive Deeper?

This analysis provides a solid foundation for understanding CIMB Niaga’s asset size. For a more in-depth understanding, explore their official financial statements and reports. Stay updated on the Indonesian financial landscape and CIMB Niaga’s performance to make informed decisions.

In conclusion, assessing CIT Bank’s asset size requires a multifaceted approach that goes beyond simply stating the total value. A thorough understanding of the asset composition, its evolution over time, and the associated risks provides a comprehensive picture of the bank’s financial health. By comparing CIT Bank’s asset size and composition to its competitors and industry benchmarks, we can develop a more informed perspective on its overall performance and future prospects.

Further research into specific asset categories and their contributing factors would provide even greater clarity.

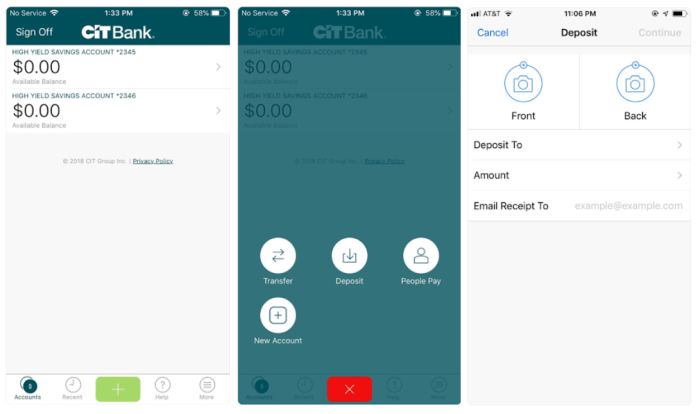

Source: creditdonkey.com